Today, we delve into the multifamily real estate landscape, exploring the intricate dance between supply and demand, rent fluctuations, construction trends, sales activity, and the broader economic context. The second quarter of 2023 has unfolded against a backdrop of both opportunities and challenges for investors and stakeholders in the multifamily sector.

Demand and Supply Dynamics

Over the past six quarters, the multifamily market has been characterized by supply outpacing demand, a trend that persisted through Q2 2023. While there was a positive sign of apartment demand recovering, with over 105,000 units absorbed during the quarter, it still fell short of the 145,000 new units delivered. This supply-demand imbalance led to a 10-basis point increase in the national vacancy rate, reaching 6.8% midway through 2023.

Notably, Midwest and Northeast markets have demonstrated resilience, with only marginal declines in year-over-year rent growth. The top five rent growth leaders at the end of Q2 2023 include Cincinnati, Northern New Jersey, Columbus, Indianapolis, and Chicago, reflecting strength and balance in mature markets, with rent growth ranging from 3.4% to 4.2%.

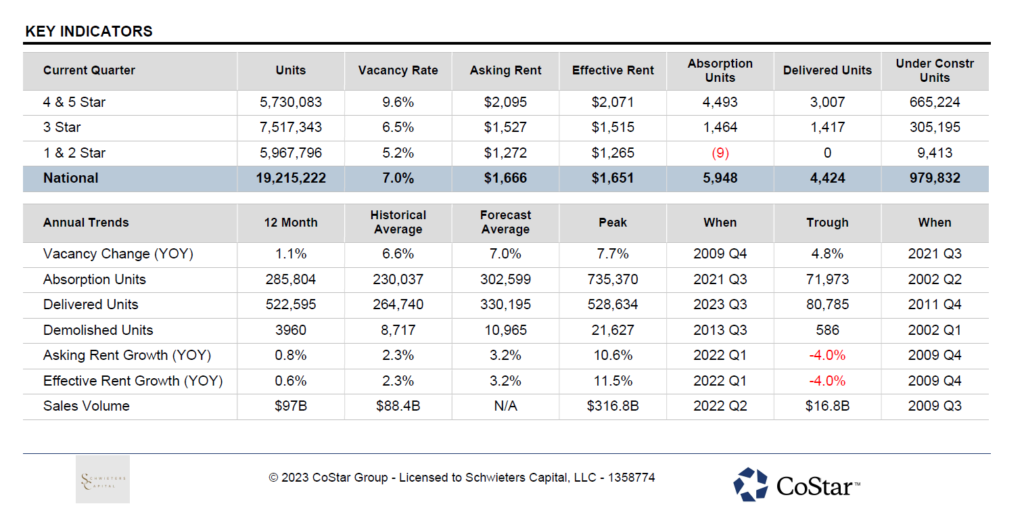

Conversely, Sun Belt markets have seen significant rent growth slowdowns, with Austin and Las Vegas experiencing year-over-year rent growth declines of -4.0% and -2.8%, respectively. The national vacancy rate is expected to finish the year in the mid-7% range, 100 basis points higher than pre-pandemic levels. To visualize these trends more effectively, take a look at the Key Performance Indicators (KPIs) depicted below.

Construction and Supply

The multifamily sector is witnessing an unprecedented surge in construction, with more than 1 million units currently under construction—the largest pipeline since the early 1970s. Projections indicate 554,000 units will be delivered this year alone. However, the Sun Belt region, responding to in-migration during the pandemic, has seen deliveries increase by 64% since 2019, potentially leading to oversupply in many markets.

The supply glut has driven the national vacancy rate up by over 200 basis points from its all-time low of 4.7% in Q3 2021 to 7.0% in Q2 2023. This trend may continue, especially in Sun Belt markets.

Mid- and high-rise buildings comprise the majority of new developments, a shift from garden-style apartments seen in earlier years. Office building conversions to multifamily units have been a hot topic, but the number of conversion projects in progress remains low.

Fifteen markets are projected to see record deliveries in 2023, primarily in the Sun Belt region. However, rising interest rates and a pullback in construction lending may lead to a meaningful pause in deliveries toward the end of 2024, potentially allowing overbuilt Sun Belt markets to stabilize more quickly.

Rent Trends

National rent growth has decelerated, dropping from 2.9% at the end of March to 0.8% in Q2 2023. This slowdown is particularly pronounced in 4 & 5 Star properties, where rent growth turned negative over the past 90 days. Sun Belt markets no longer dominate rent growth leaderboards, with the Midwest region now leading the nation in terms of rent growth.

However, some markets, such as Palm Beach and Las Vegas, have experienced steep rent slowdowns, while Minneapolis has held up relatively well.

CoStar projects that national year-over-year rent growth will remain close to the current 1.2% for the remainder of 2023. Markets in the Midwest and Northeast are expected to experience the strongest rent growth this year.

Sales Activity

Multifamily sales activity has shown signs of stabilization through the first nine months of 2023. Transaction volume, while down significantly from the peak in Q4 2021, has straddled $19 billion quarterly. Buyers are showing a preference for higher-quality assets, driven by marked-down prices and a desire to mitigate risk.

Investors’ approaches are adapting to evolving rent growth patterns, reshuffling sales volume rankings. Private buyers have gained market share in 2023, as institutional capital took a breather amid rising interest rates.

Pricing Trends

Pricing trends have also shifted, with declining property values and rising yield requirements. Cap rates for 4 & 5 Star assets now range in the high 4% to mid-5% range, while 3-Star assets are in the upper 5% spectrum. Older, less luxurious assets are pushing north of the 6% threshold.

Economic Context

The U.S. economy remains resilient as the Federal Reserve raises interest rates to curb inflation. Economic growth in Q2 2023 surpassed expectations, but forecasters still anticipate a mild recession later this year or early next year. Factors such as rising prices, declining household formations, and weakening demand present temporary obstacles.

In conclusion, the multifamily real estate sector is a dynamic landscape where supply-demand imbalances, rent fluctuations, construction trends, and economic factors all come into play. As we navigate these shifting sands, it’s essential for investors and stakeholders to remain adaptable and strategic. Stay tuned for more updates on the ever-evolving world of multifamily real estate.